In October and November 2005, I was invited to present a thesis on project financing by various academic organizations such as the Korean Sports and Entertainment Law Association and the Korean Economic Law Association.

Though I was very busy in preparing those theses, it was of great importance for me to explain the unique financing scheme which would be applied in financing professional sports facilities and rehabilitating infrastructure in North Korea, and so on.

The followings are the abstracts of each seminar presentation, of which full texts in Korean will be carried on the forthcoming issues of the pertinent law journals.

How to Apply a Project Financing Scheme in the Reconstruction of Infrastructure in North Korea

- At the seminar hosted by the Korean Economic Law Association at Sungkyunkwan University, on November 4, 2005

As the Six Party Talks in Beijing give rise to a hope the North nuclear issue could be settled sooner or later, a huge amount of economic grant to the North would be necessary. So far several suggestions have been made that a project financing would be useful to the North-South economic cooperation. This article is to study a feasible action programme for such a financing scheme, which requires the followings: - There should be long-term stable cash flows; - The project should function as a catalyst and reliable resources to further economic development; and - The North Korean technocrats could learn how to handle large-scale projects.

Highway construction projects are believed to satisfy the above-mentioned conditions. Gaeseong-Shineuju Highway, which will be named as a part of Asian Highway No.1 (AH1), would meet the logistic needs of manufacturers and merchants from South Korea and northern provinces of China as well.

The construction projects of North Korean highways could be supported by, at first the North-South Cooperation Fund of South Korea, and next, the concerted efforts by the United States, European countries and supranational institutions like the World Bank and the Asian Development Bank.

We can find an effective example from the West and East German relations before the unification. In the 1970s, West Germany helped East Germany reconstruct the highways leading to West Berlin. The West German government paid to East Germany the aggregate toll money in advance, which was often used as collateral for future foreign borrowings.

If this kind of financial scheme proves to be successful, the construction of such throughputs as pipelines and electric power lines could be financed in a similar way employing a project financing tool.

Developing Financial Structures for the Promotion of Professional Sports in Korea

- At the seminar hosted by the Korean Sports and Entertainment Law Association at Seoul National University, on November 5, 2005

Hundreds of thousands of enthusiastic football fans, "Be the Reds", gathering at the Seoul City Plaza for the 2002 World Cup Games showed that sport could change the collective psychology of a contemporary society. When the World Cup Games were over, however, those World Cup stadiums turned into something like ghost towns. Since most of them are not used more than a few times a year, there is an increasing need to make the most of such facilities other than eternal monuments to past sporting memories.

Recently Samsung Group abruptly withdrew its sponsorship for the 2005-06 Professional Basketball Games, confronted with politicians' arguments against the Samsung-only sponsorship. President Noh said that the government will exert every effort to develop value-added sporting goods, to enhance the domestic sports leisure industries to the top notch in quality and variety, and to consolidate the infrastructure of professional sports.

These circumstances show that it is time to develop and employ more innovative financing techniques rather than traditional financing methods for sports facilities.

In the United States, there has been a boom in sports facility construction since 1990. According to the Fitch Report on "Changing Game of Sports Finance"(797 PLI/Comm 841), of the 120 or more professional franchises in the four major sports leagues - National Basketball Association, National Football League, Major League Baseball, National Hockey League - more and more teams are seeking new facilities or have new facilities under construction. In the meantime, the financing of sports facilities has shifted from the public finance debt market to sports facility revenue based project financing and securitization transactions.

Sports facility debt has been issued in the U.S. municipal bond markets. Also, project finance transactions have been arranged in the financial markets, and, more recently, some facility related revenue streams have been successfully securitized. Consequently, such revenue streams and cash flows have to be reinforced by solid lease agreements with the anchor tenants, premium seat license agreements, long-term contracts with concessionaires and TV broadcasters, naming rights agreements, title sponsors and advertisers. Projected cash flows for project financing transactions must undergo various stress test scenarios. Financial projections must be able to withstand several sensitivity analyses. For example, a credit rating agency like Fitch may assess such asset-backed transactions as an investment grade on condition that they maintain a debt service coverage ratio (DSCR) of at least 1.0x, exclusive of the debt service reserve account, subsequent to each debt service payment.

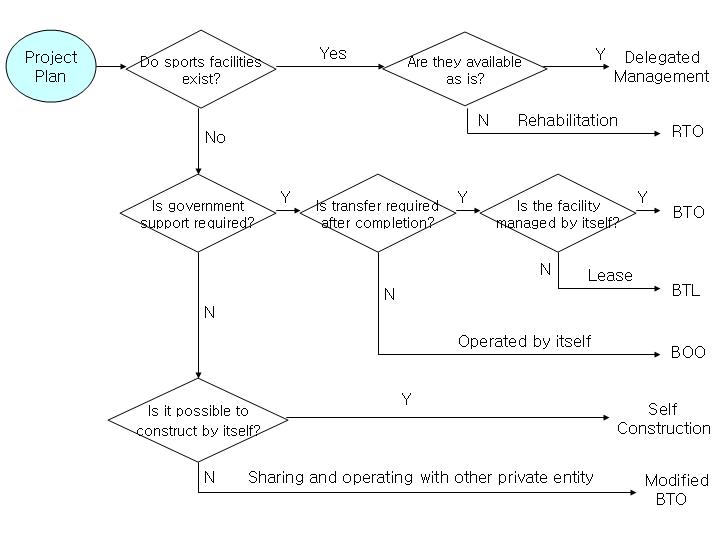

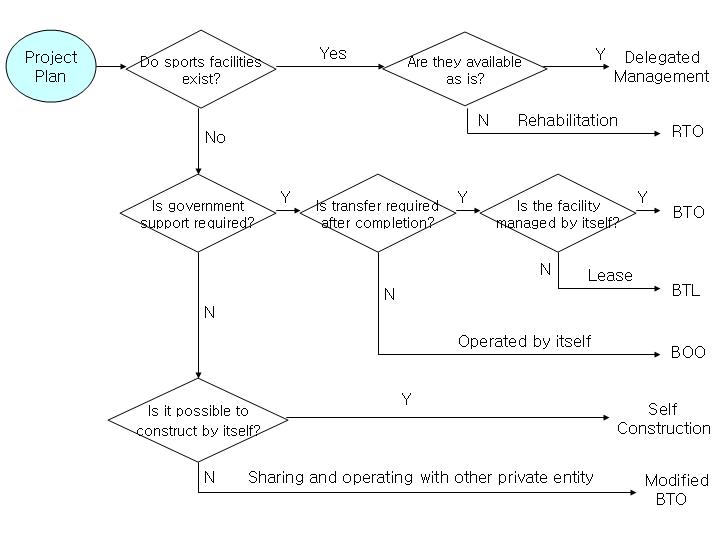

A professional sports franchise may use a stadium, arena or ballpark by either a lease agreement or delegated management agreement with a host municipality. The franchise may employ, as the case may be, the method of BOO (build-own-operate), BTO (build-transfer-operate), ROT (rehabilitate-operate- transfer), or BTL (build- transfer-lease) in securing the sports facilities. The selection of the financial structure, based upon the given conditions and situation of the sports facilities, could be processed in the following diagram.

In all traditional project finance and those structures incorporating elements of securitization, security is derived from pledged revenues and often a mortgage on the building and improvements. The collateral usually includes possible revenue streams, the right to future revenues, the right to enter into future contracts, and the right to renew contracts.

Also it is advisable to establish a project company as a special purpose vehicle (SPV) to apply for the government support in accordance with the Act on Private Investment to the Social Infrastructure Facilities (the "Private Investment Act"). Then it is required for the SPV to build and operate the sports facilities open to the local residents' use. The newly amended Private Investment Act has adopted a BTL method in implementing SOC projects by expanding the scope of social infrastructure to sports facilities, school buildings, hospitals, health care facilities, and so on.

When professional sports facilities are to be constructed on the BTL basis, asset-backed lending is available with the lease paid regularly by the public sector as collateral. Otherwise, the facility related revenue streams could be securitized into asset-backed securities. In this case, SPV would raise the considerable portion of funds necessary to construct the facilities in advance.